![Residential Distressed Properties for Fourth Quarter (October-December) 2014]()

by RMLS Communication Department | Jan 20, 2015 | Distressed Properties, Industry News, Market Trends, Statistics

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Area Distressed Properties (4th Quarter 2014)

• Clark County, WA Distressed Properties (4th Quarter 2014)

• Lane County, OR Distressed Properties (4th Quarter 2014)

• Douglas County, OR Distressed Properties (4th Quarter 2014)

• Coos County, OR Distressed Properties (4th Quarter 2014)

Here are some additional facts about distressed residential properties in the fourth quarter of 2014:

All areas when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.9% (12.0 v. 7.1%).

• In a comparison of the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.7% (9.5 v. 8.8%).

• Short sales comprised 3.5% of new listings and 3.0% of sales in the fourth quarter of 2014, up 0.9% and down 0.3% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.5% of new listings and 6.5% of sales in the fourth quarter of 2014, up 4.0% and 1.0% from the third quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.5% (10.7 v. 6.2%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 1.0% (8.2 v. 7.2%).

• Short sales comprised 3.8% of new listings and 2.9% of sales in the fourth quarter of 2014, up 1.2% and down 0.4% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 6.9% of new listings and 5.3% of sales in the fourth quarter of 2014, up 3.3% and 1.4% from the third quarter of 2014, respectively.

Clark County when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 3.9% (12.7 v. 8.8%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.4% (11.5 v. 11.1%).

• Short sales comprised 4.4% of new listings and 4.3% of sales in the fourth quarter of 2014, up 0.6% for new listings and down 0.4% for sales when compared to the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.3% of new listings and 7.2% of sales in the fourth quarter of 2014, up 3.3% and 0.8% from the third quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for Fourth Quarter (October-December) 2014]()

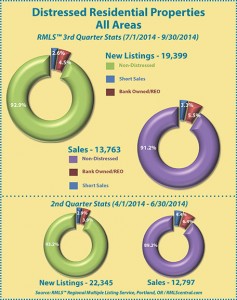

by RMLS Communication Department | Oct 16, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

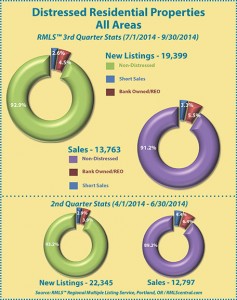

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the third quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (3rd Quarter 2014)

• Clark County, WA Distressed Properties (3rd Quarter 2014)

• Lane County, OR Distressed Properties (3rd Quarter 2014)

• Douglas County, OR Distressed Properties (3rd Quarter 2014)

• Coos County, OR Distressed Properties (3rd Quarter 2014)

Here are some additional facts about distressed residential properties in the third quarter of 2014:

All areas when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.3% (7.1 v. 6.8%).

• In a comparison of the third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 2.0% (8.8 vs. 10.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.3% and 1.1% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.5% of new listings and 5.5% of sales in the third quarter of 2014, up 0.6% and down 0.9% from the second quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.1% (6.2 vs. 6.1%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 1.6% (7.2 v. 8.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.4% and 0.8% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.6% of new listings and 3.9% of sales in the third quarter of 2014, up 0.5% and down 0.8% from the second quarter of 2014, respectively.

Clark County when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings decreased by 0.6% (8.8 v. 9.4%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 4.7% (11.1 v. 15.8%).

• Short sales comprised 3.8% of new listings and 4.7% of sales in the third quarter of 2014, down 0.9% for new listings and 2.0% for sales when compared to the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 5.0% of new listings and 6.4% of sales in the third quarter of 2014, up 0.3% and down 2.7% from the second quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for Fourth Quarter (October-December) 2014]()

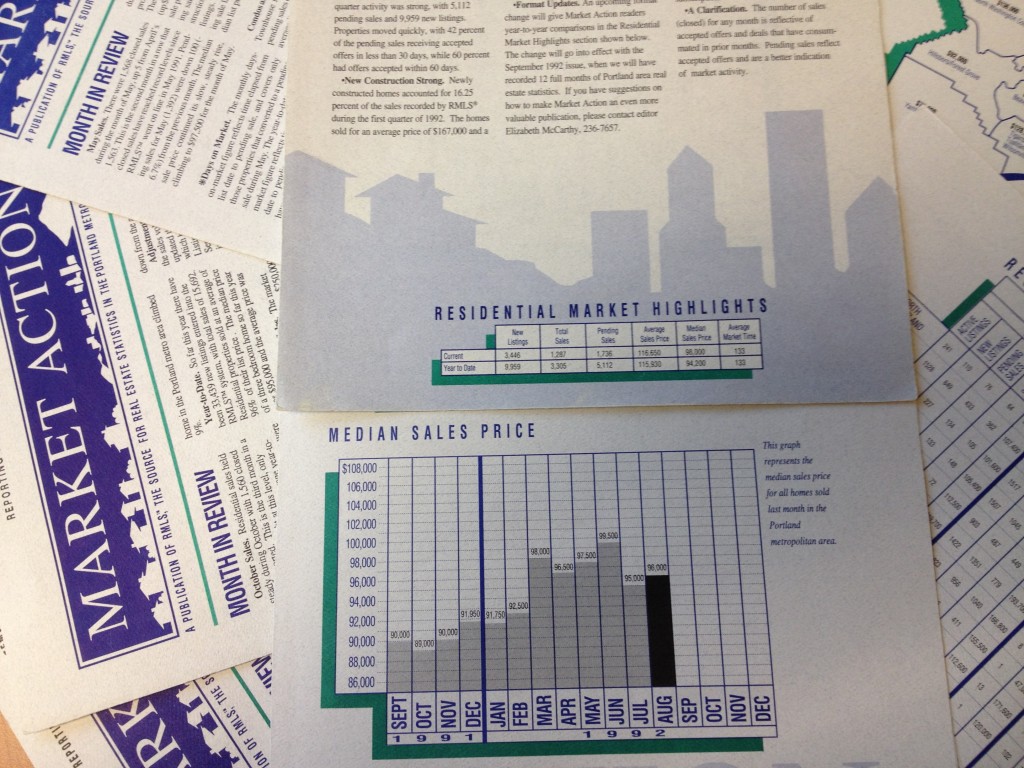

by RMLS Communication Department | Aug 29, 2014 | RMLS Market Action, Statistics

This post is part of MLS Insight, a series about how things work at RMLS™.

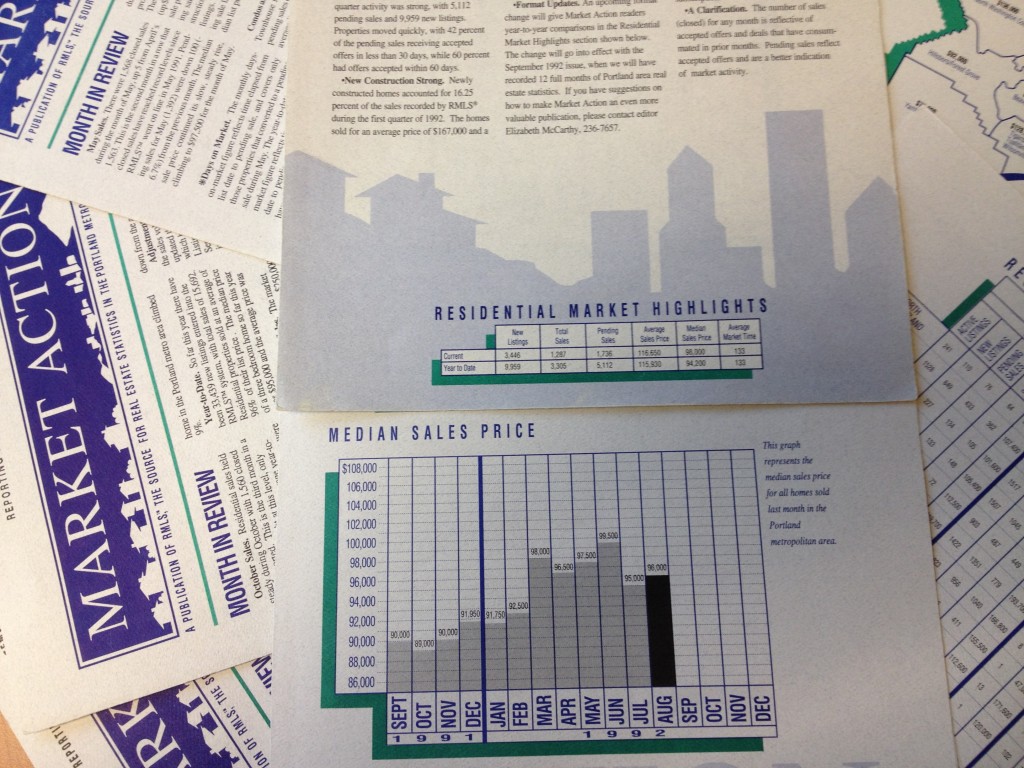

In our early years, RMLS™ leadership had the goal of positioning RMLS™ as the primary source for information about the residential real estate market—so statistical information has always been a priority. Then and now, RMLS™ provides compiled data and directs media to working REALTORS® for interpretation and projections.

In other words, our expertise is the WHAT, and we leave the WHY to industry professionals who have access to the buyers and sellers whose activity underpins the data on sales, prices, and listings.

Market Action

The first issue of our monthly statistical newsletter, Market Action, was published as four printed pages in March 1992. Today Market Action is 69 pages long and covers all the market areas we serve. Next year, we will be expanding coverage to include separate stats for new construction and existing homes. Watch for a survey question in our Annual Subscriber Satisfaction Survey to weigh in on the most important data to include, or leave a comment below.

Market Trends and Market Stats

To explore the other statistics reports that RMLS™ has to offer, head to the Statistics tab on the RMLSweb menu bar.

RMLSweb also features video tutorials on how to use both Market Trends and Market Stats. (You can find these and others on RMLSweb by clicking on Training Tutorials under the Toolkit menu.)

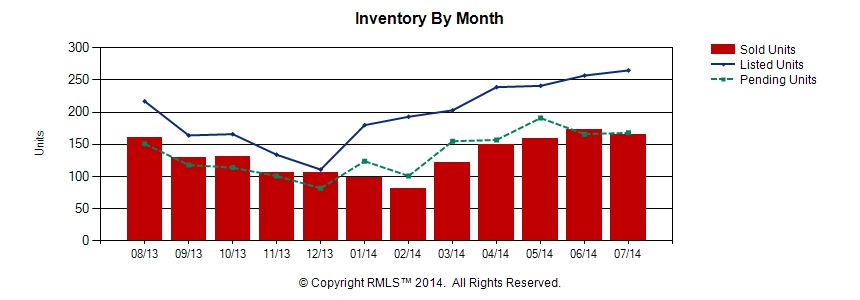

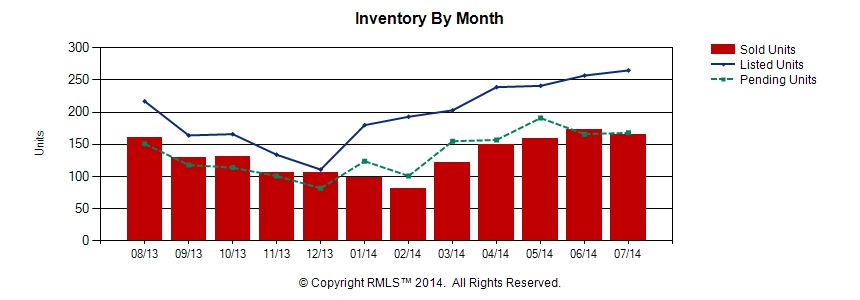

Market Trends allows searching by geography (area number, city, ZIP code) and a few other criteria such as bedrooms, year built, lot size, etc. The resulting report produces not only a summary of data by month within the range you select, but also six graphs like the one below that are a click away from copying for your use in your own CMAs or newsletters.

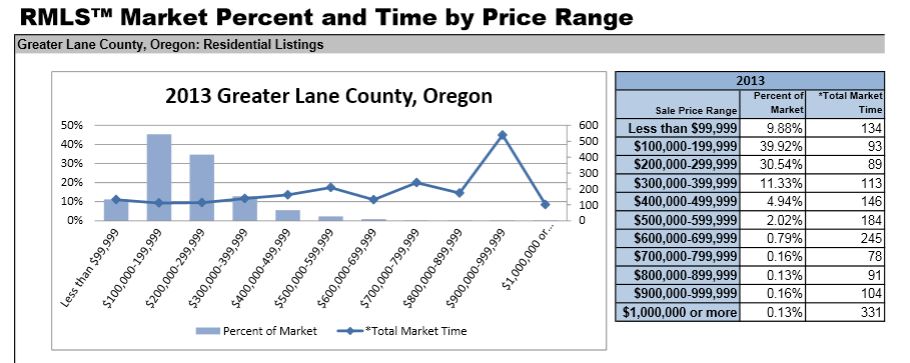

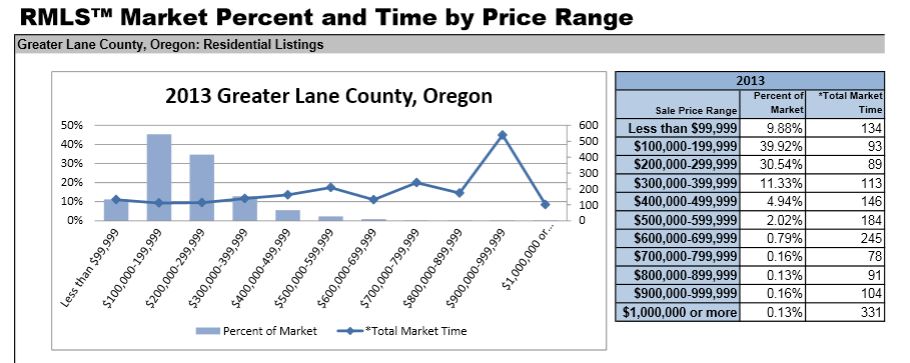

Market Stats provides several reports. The Comparables Report has several additional graphs which depict sales data by sold terms and number of bedrooms. (See below for the type of info available in the Comparables Report.) The Dollar Value by Area and Inventory Reports are strictly data reports that give a very streamlined overview of market areas.

Home Sales Report

In addition to these dynamic reports which pull data according to criteria you select, RMLS™ also provides static reports under the Statistics menu. The Home Sales Report has information as early as 2001. Since July 2011, these reports have presented information for new construction—both separate from existing and combined.

Statistical Summaries

Finally, the Statistical Summaries compile years worth of Market Action historical data into a few pages and provide up to nine annual snapshots of various aspects of the residential real estate market in all our market areas. Access them under the Statistics menu on RMLSweb.

As you can see, RMLS™ takes stats seriously! If you would like to learn more about how to use stats in your business, call RMLS™ Training at (503) 236-7657 to get more information.

Thanks for taking this brief tour highlighting some of the statistical information available from RMLS™. Next month we will talk about envisioning an MLS without area numbers. If you have any questions you would like to have answered about how things work at RMLS™, I encourage you to post a comment to this blog.

![Residential Distressed Properties for Fourth Quarter (October-December) 2014]()

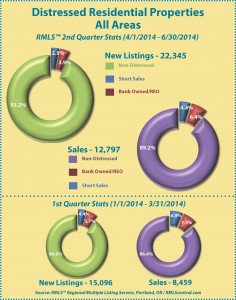

by RMLS Communication Department | Jul 16, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

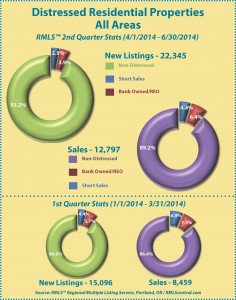

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the second quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (2nd Quarter 2014)

• Clark County, WA Distressed Properties (2nd Quarter 2014)

• Lane County, OR Distressed Properties (2nd Quarter 2014)

• Douglas County, OR Distressed Properties (2nd Quarter 2014)

• Coos County, OR Distressed Properties (2nd Quarter 2014)

Here are some additional facts about distressed residential properties in the second quarter of 2014:

All areas when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.3% (6.8 v. 10.1%).

• In a comparison of the second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.8% (10.8 v. 13.6%).

• Short sales comprised 2.9% of new listings and 4.4% of sales in the second quarter of 2014, down 1.5% and 1.9% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.9% of new listings and 6.4% of sales in the second quarter of 2014, down 1.8% and 0.9% from the first quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 2.8% (6.1 v. 8.9%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.2% (8.8 v. 11.0%).

• Short sales comprised 3.0% of new listings and 4.1% of sales in the second quarter of 2014, down 1.3% and 2.0% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.1% of new listings and 4.7% of sales in the second quarter of 2014, down 1.5% and 0.2% from the first quarter of 2014, respectively.

Clark County when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.1% (9.4 v. 12.5%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 7.3% (15.8 v. 23.1%).

• Short sales comprised 4.7% of new listings and 6.7% of sales in the second quarter of 2014, down 1.2% for new listings and 4.2% for sales when compared to the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.7% of new listings and 9.1% of sales in the second quarter of 2014, down 1.9% and 3.1% from the first quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for Fourth Quarter (October-December) 2014]()

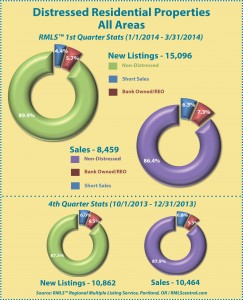

by RMLS Communication Department | Apr 17, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

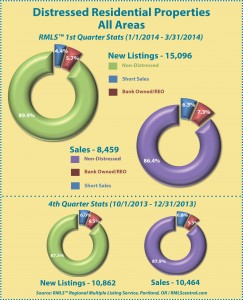

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the first quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (1st Quarter 2014)

• Clark County, WA Distressed Properties (1st Quarter 2014)

• Lane County, OR Distressed Properties (1st Quarter 2014)

• Douglas County, OR Distressed Properties (1st Quarter 2014)

• Coos County, OR Distressed Properties (1st Quarter 2014)

Here are some additional facts about distressed residential properties in the first quarter of 2014:

All areas when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 2.4% (10.1 v. 12.5%).

• In a comparison of the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 1.5% (13.6 v. 12.1%).

• Short sales comprised 4.4% of new listings and 6.3% of sales in the first quarter of 2014, down 1.6% and 0.5% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 5.7% of new listings and 7.3% of sales in the first quarter of 2014, down 0.8% and up 2.0% from the fourth quarter of 2013, respectively.

Portland metro when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 1.7% (8.9 v. 10.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 0.2% (11.0 v. 10.8%).

• Short sales comprised 4.3% of new listings and 6.1% of sales in the first quarter of 2014, down 1.7% and 1.1% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 4.6% of new listings and 4.9% of sales in the first quarter of 2014, even with and up 1.3% from the fourth quarter of 2013, respectively.

Clark County when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 6.1% (12.5 v. 18.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 5.5% (23.1 vs. 17.6%).

• Short sales comprised 5.9% of new listings and 10.9% of sales in the first quarter of 2014, up 2.3% for new listings and 1.8% for sales when compared to the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.6% of new listings and 12.2% of sales in the first quarter of 2014, down 3.8% and up 3.7% from the fourth quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.