by RMLS Communication Department | Aug 31, 2009 | Lockbox, Market Trends, Statistics

Lockbox activity up slightly

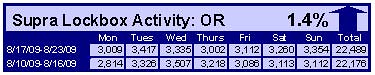

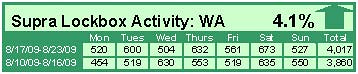

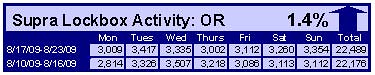

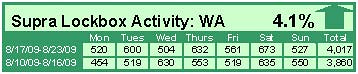

After a drop last week, lockbox activity bounced back in the week of August 17-23 compared to the prior week. In Washington, the number of times RMLS™ subscribers opened Supra lockboxes increased 4.1% and in Oregon activity was up 1.4%.

Click the chart for a larger view (Washington, top; Oregon, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Aug 24, 2009 | Lockbox, Oregon Real Estate, Statistics, Washington Real Estate

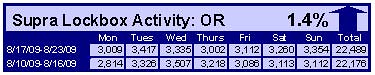

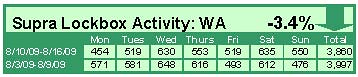

Lockbox activity down slightly

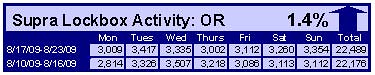

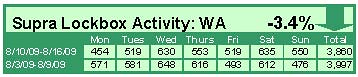

After an increase last week, lockbox activity dipped slightly in the week of August 10-16 compared to the prior week. In Washington, the number of times RMLS™ subscribers opened Supra lockboxes decreased 3.4% and in Oregon activity was down 1.4%.

Click the chart for a larger view (Washington, top; Oregon, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Aug 24, 2009 | Homeownership, Market Trends, Oregon Real Estate, Portland, Statistics

There’s been some encouraging news lately in the RMLS™ market areas. The number of sales and pending sales are finally outpacing the totals from the same month in 2008. How much of it might be a result of the $8,000 first-time homebuyer tax credit, though?

I recently put together some statistics for the Oregonian on the Portland metro area, and thought I would share them with you.

There is no question that home sales in the lower-end of the market have seen a big jump this year. In 2007, homes priced between $0 and $249,999 only made up 35% of all sales in the Portland metro area. In 2009 so far, they make up 49.6% of the market.

As you’d expect, coinciding with the increase in lower-end homes is a drop in high-end homes. Homes priced $500,000 or above have dropped from 13.5% of the market in 2007, to just 8.2% of the market this year.

Click on the graph for a larger view

The question is: what will happen when the $8,000 tax credit expires on December 1?

I know the tax credit definitely got me off the fence & I can literally think of 15 of my friends and acquaintances (off the top of my head) who have bought or are actively looking to buy.

So in my humble opinion, there’s little doubt that the tax credit spurred people to buy. But as the deadline for the credit approaches, it should be interesting to see where sales go.

by RMLS Communication Department | Aug 13, 2009 | Clark County, Coos County, Curry County, Douglas County, Lane County, Market Trends, Oregon Real Estate, Portland, Statistics, Union County, Washington Real Estate

We released the latest Market Action reports to RMLS™ subscribers yesterday. Many areas of Oregon and Southwest Washington are showing improvement as far as sales and inventory go – here are a few highlights:

Portland Metro Active Listings: Note how the 2009 line is basically flat.

Inventory: Inventory is showing steady improvement in Portland (7.3 months), Clark County (7.3 months), and Lane County (6.2 months). In most circles, 6 months of supply is considered a balanced market. The drop in inventory comes thanks to strong closed sales, but also because the number of active listings is growing at a much slower pace than usual.

Closed sales: The Portland metro area was finally able to post a gain in same-month closed sales for the first time since April 2007. Closed sales were up 8.6% compared to last July. Clark County posted a gain for the second straight month – closed sales were up 23.5% there. Lane County also posted an 11% gain. Baker County, Curry County, Douglas County, and the Mid-Columbia region also saw growth.

Clark Co. Pending Sales: Oh, so close to reaching July 2007 levels.

Pending sales: Same-month pending sales in Clark County grew for the fourth month in a row at 30.3%. In fact, Clark County pending sales not only surpassed July 2008 levels, but they came close to hitting July 2007 levels. With the exception of the Mid-Columbia region and Union County, same-month pending sales grew in all of our primary service areas.

by RMLS Communication Department | Aug 10, 2009 | Lockbox, Statistics

Downward trend continues

Comparing July 20, 2009 through August 2, 2009 the number of times RMLS™ subscribers opened Supra lockboxes decreased 15% in Washington and 5.4% in Oregon.

Click the chart for a larger view (Oregon, left; Washington, right)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.