by RMLS Communication Department | Sep 28, 2009 | Lockbox, Market Trends, Oregon Real Estate, Portland, Statistics, Washington Real Estate

Lockbox Activity Down In Washington, Up In Oregon

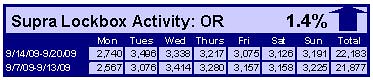

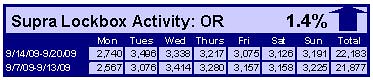

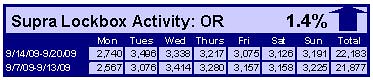

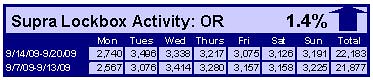

When comparing the week of September 14-20 with the week prior, the number of times an RMLS subscriber opened a Supra lockbox decreased 1.2% in Washington and increased 1.4% in Oregon.

Click the chart for a larger view (Washington, top; Oregon, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Sep 16, 2009 | Clark County, Coos County, Curry County, Douglas County, Lane County, Market Trends, Oregon Real Estate, Portland, Statistics, Union County, Washington Real Estate

Same-month sales improve, but inventory rises in many areas

Pending sales in Clark County surpassed August 2008 & 2007 totals

Sales Activity

Sales activity (pending sales & closed sales) outpaced totals from last August in several areas. Clark County continues to post impressive numbers in this category, as pending sales were up 24.9% and closed sales increased 21.4%. Portland posted a 13% increase in pending sales and 4% in closed sales.

In Southern Oregon, Curry County saw a big jump in pending sales, a 75% increase over last August. Coos County, the Columbia Basin region and Baker County also saw pending and closed sales grow.

Housing Inventory

Inventory, on the other hand, rose in many areas this month. However, most of the increases were modest and inventory remains well below 2008 levels.

Portland saw inventory rise to 7.8 months, up from 7.3 in July, but was still 21% below where inventory was in August 2008. Clark County, similarly, was at 8 months in August, but that was 37% lower than August 2008, when inventory stood at 12.7 months.

Baker, Curry, Douglas & Lane counties and the Mid-Columbia region all saw inventory increase in August, but in all cases, it was still lower than 2008.

Days on Market

You may have noticed that this month we have comparable data for the “Total Market Time” (TMT) statistical category. This is the amount of time that it takes from when a property is listed to when an offer is accepted on that same property. If the property is re-listed within 31 days, TMT continues to accrue; however, it does not include the time that it was off the market.

We started tracking this stat in August 2008, so we finally had comparable data this month. As you may recall, we used to measure “Current Listing Market Time” instead, this measure was less accurate as it only tracked the amount of time that a listing was on the market, it did not track the property address (so if it was re-listed, it would reset).

Overall, it appears that it is taking more time to market properties, all of our market areas saw increases compared to last August, with the exception of the Columbia Basin region and Union County.

In Portland it took 135 days to sell a property, up 11.5% from last August when it took 121 days.

by RMLS Communication Department | Aug 24, 2009 | Homeownership, Market Trends, Oregon Real Estate, Portland, Statistics

There’s been some encouraging news lately in the RMLS™ market areas. The number of sales and pending sales are finally outpacing the totals from the same month in 2008. How much of it might be a result of the $8,000 first-time homebuyer tax credit, though?

I recently put together some statistics for the Oregonian on the Portland metro area, and thought I would share them with you.

There is no question that home sales in the lower-end of the market have seen a big jump this year. In 2007, homes priced between $0 and $249,999 only made up 35% of all sales in the Portland metro area. In 2009 so far, they make up 49.6% of the market.

As you’d expect, coinciding with the increase in lower-end homes is a drop in high-end homes. Homes priced $500,000 or above have dropped from 13.5% of the market in 2007, to just 8.2% of the market this year.

Click on the graph for a larger view

The question is: what will happen when the $8,000 tax credit expires on December 1?

I know the tax credit definitely got me off the fence & I can literally think of 15 of my friends and acquaintances (off the top of my head) who have bought or are actively looking to buy.

So in my humble opinion, there’s little doubt that the tax credit spurred people to buy. But as the deadline for the credit approaches, it should be interesting to see where sales go.

by RMLS Communication Department | Aug 3, 2009 | Lockbox, Market Trends, Oregon Real Estate, Statistics, Washington Real Estate

Activity continues to slide, slightly

Comparing July 13, 2009 through July 26, 2009 the number of times RMLS™ subscribers opened Supra lockboxes decreased 1.4% in Washington and 1.9% in Oregon.

Click the chart for a larger view (Oregon, top; Washington, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Jul 16, 2009 | Clark County, Coos County, Curry County, Douglas County, Lane County, Market Trends, Oregon Real Estate, Portland, Statistics, Union County, Washington Real Estate

The latest issue of the RMLS™ Market Action for June 2009 shows increases in accepted offers, closed sales and a decrease in inventory in several regions.

Accepted Offers

The five county Portland Metro Area saw a month-over-month increase in pending sales (8.4% comparing June 2009 with June 2008) for the first time since December 2006. Pending sales also increased for the third month in a row in Clark County, Washington. The following regions also saw an increase in pending listings in June 2009: Coos, Curry, Douglas, Lane, Mid-Columbia and Union.

Closed Sales

Closed sales in Clark County increased14.8% comparing June 2009 with June 2008. This is the first increase since September 2008.

The following regions also experienced increases in closed sales: Columbia Basin, Curry, Douglas and Mid-Columbia.

Inventory

Inventory in all three of our largest service areas (Portland Metro, Clark County and Lane County) dipped to the lowest it’s been since August 2007. In addition, the following counties experienced drops in inventory from the previous month: Columbia Basin, Coos, Curry and Douglas.