by RMLS Communication Department | Jun 18, 2009 | Market Trends

One of the most interesting statistics I saw in the latest issues of Market Action was the increase of pending sales compared to May 2008 in Clark County. This was the second month in a row that the number of pending sales rivaled that of the same time period a year ago. This is good news! But what caught me by surprise was that the number of closed sales is still down from the same time a year ago.

So I started to wonder:

1) On average how long does it take for pending listings to show up as sold? According to the National Association of Realtors® pending home sales typically “become existing-home sales one-to-two months later.”

2) What percentage of accepted offers fail these days? Using a formula that I got from my new friend Chuck Reiling, a real estate professional in Seattle, WA, I took a stab at calculating the fallouts for properties in Clark County.

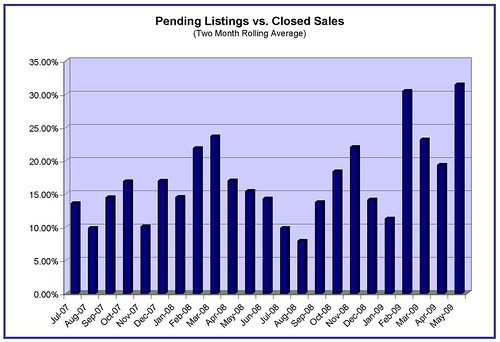

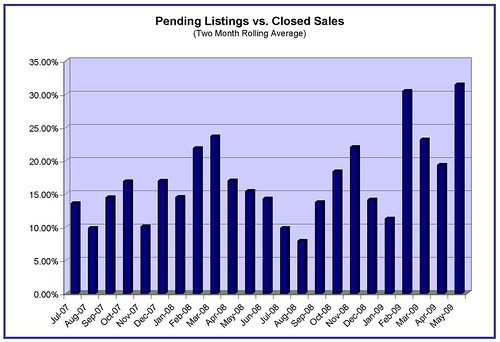

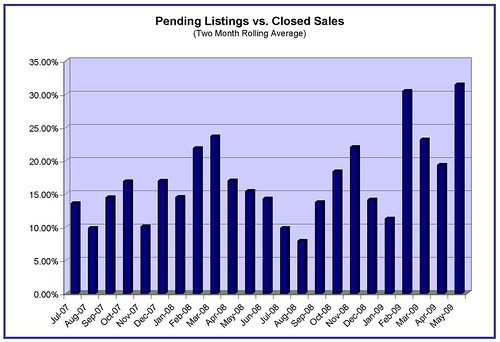

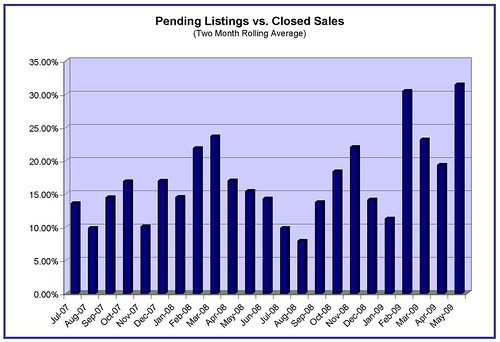

Following Chuck’s formula I looked at the pending listings monthly from May 1, 2007 to May 31, 2009 and the closed sales from June 1, 2007 to May 31, 2009. Like Chuck I staggered the pendings by one month to allow for a “typical” close time and I used a two month running average to adjust for variances.

Here’s a graph of the ratios:

The average pending vs. closed sale ratio is 17 percent. You’ll notice that the last few months have all been above that rate, with May 2009 coming in at 31.4 percent (the highest so far).

According to Eric Newman, a Mortgage Banker with Summit Mortgage Corp, these numbers may not actually reflect sale fails, but rather sale delays. Newman says that these days there are a number of factors that increase closing time, from waiting on bank approval when needed (approximate average of three weeks) to overwhelmed underwriters (current response time for FHA loans is around 21 days).

For example, I did a quick search in RMLSweb and discovered that out of the 552 properties that went pending in Clark County in April, approximately 117 were marked as requiring 3rd party approval (not all of these listings are short sales, but most of them are) and 122 were listed as bank owned. That’s almost half of the pending listings – 43 percent.

While it’s likely that a percentage of these more complicated transactions do fail, it also may be that these listings take longer to close so the typical one month lag may not apply. Newman says we would expect that most of those pending listings will probably not be recorded as closed until June because many loans are taking 45 to 60 days to close in the current market.

What do you think? What are you seeing out in the field?

by RMLS Communication Department | Jun 16, 2009 | Events

Here’s a quick rundown of upcoming Realtor® events & education in our service areas for the rest of June. If you have an event that is not listed here, please let us know by commenting below. For future events, please send an e-mail to communications (at) rmls (dot) com.

Vancouver Fine Homes Group Tour, June 18: The next Vancouver Fine Homes Group tour will be on Thursday, June 18 starting at 9 a.m. They will be touring the East side of the county. Visit www.vancouverfinehomes.org for more information.

Eugene Association of Realtors, Principal Brokers Roundtable Forum – Short Sales, June 19: http://www.eugenerealtors.org/education_events.html

CCAR June Membership Meeting, June 25: Hear tips on how to best integrate some of today’s hottest social media tools, including Twitter, LinkedIn and Facebook into your current marketing plan. Register here: http://ccrealtors.com/downloads/junemtg.pdf

Springfield Homebuyers Fair, June 27: http://www.ci.springfield.or.us/CMO/NewsRelease/NR%202009%20May%2029%20Mayor%20Sid%20Leiken%20to%20Proclaim%20June%20as%20National%20Homeownership%20Month.pdf

Image courtesy of Ayhan Yildiz

by RMLS Communication Department | Jun 15, 2009 | Lockbox, Market Trends, Statistics

The latest information from Supra shows lockbox openings were up from the previous week in Oregon and Washington.

by RMLS Communication Department | Jun 10, 2009 | Tips & Tricks

We sometimes get reports of homes being entered into RMLSweb as detached homes, when they are in fact, attached (or vice versa). We realize this can be confusing at times, so let’s briefly review the attached v. detached question.

Let’s start with the textbook definitions:

“Attached: An element of the residence’s construction (such as a wall, ceiling, or floor) is shared with another property. Condominiums excluded.”

“Detached: A stand-alone residence, excluding manufactured homes, for which the sale includes the land on which the residence is located.”

Now – remember how your teachers would have you come up with acrostic poems? It’s when you take each letter of your name or a word & you have to use it as the first letter in each line of the poem (here are instructions on how to write an acrostic poem… in case you wanted to know).

We came up with one each for Attached & Detached houses to help you remember the difference!

ATTACHED:

Adjoined

To

Things, such

As

Ceilings and walls of other

Houses,

Especially

Duplexes

DETACHED:

Disconnected from

Everyone, especially from

Those

Adjacent buildings,

Construction, and

Housing. But, connected to

Earth and

Dirt

Ok, I’m aware that acrostic poems probably won’t be particularly helpful in remembering what’s attached v. detached, but just let this silly attempt at a mnemonic device serve as a reminder to be cogniscent cognizant of the issue when entering listings. And if you’re ever unsure, feel free to give us a call!

Oh, and in case you want the original poems, I wrote them on this cool writing paper I found online:

My originals, missing is the "F" for poor penmanship.

by RMLS Communication Department | Jun 4, 2009 | Events, Homeownership

June is National Homeownership Month and if you read the blog, you probably know I am a new member of the homeowner community.

After getting through my first transaction, I can say that I definitely understand how some first time homebuyers can be intimidated by the process of buying a home. Per the old adage, “nothing good comes easy”, and I emphasize the good.

Between choosing a Realtor and a lender, finding the right home, negotiations, inspection and the mounds of paperwork at each step, it can make your head spin when you have no experience with it. Fortunately, Realtors help alleviate all of those concerns and lend understanding to each stage of the process.

However, for those first time buyers who may not have chosen a Realtor yet, or a just looking for more information, our friends over at the Portland Metropolitan Association of Realtors® (PMAR), have put together a great website for potential buyers – HOWNW.com (Homeownership Opportunities Website Northwest).

The website features a very helpful Home Buying Process section. I peeked at the site a few times before I decided to buy and found it very helpful. The site also includes a section that allows potential buyers to search for homeownership programs that may fit their needs.

Even though I had a good Realtor, along with friends, family & colleagues around me that are knowledgeable about real estate, I still found it stressful at times (I’m a worrier), so I think any other resources that can shed some light on the process are worth highlighting – here are a few others I was able to find:

American Bankers Association – National Homeownership Month Resources

CNN Money: Money 101 – Buying a Home

Portland Housing Center: Schedule for Homebuying 101 Classes

Image courtesy of John Salazar