![Distressed Properties Postscript: Looking at Cumulative Days on Market]()

by RMLS Communication Department | Apr 22, 2015 | Distressed Properties, Statistics

Click to enlarge

Click to enlarge

Ever wonder how distressed properties fare in terms of their cumulative days on market (CDOM) versus traditional listings?

RMLS™ tax data guru Kim Hutchinson has been tracking CDOM on RMLSweb since July 2009 and as a follow-up to last week’s release of the Q1 2015 residential distressed properties infographics, we put his collected monthly records into graph form.

Enjoy!

![Distressed Properties Postscript: Looking at Cumulative Days on Market]()

by RMLS Communication Department | Apr 16, 2015 | Distressed Properties, Industry News, Market Trends, Statistics

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the first quarter of 2015.

Below are links to additional charts for some of our larger areas.

• Portland Metro Area Distressed Properties (1st Quarter 2015)

• Clark County, WA Distressed Properties (1st Quarter 2015)

• Lane County, OR Distressed Properties (1st Quarter 2015)

• Douglas County, OR Distressed Properties (1st Quarter 2015)

• Coos County, OR Distressed Properties (1st Quarter 2015)

Here are some additional facts about distressed residential properties in the first quarter of 2015:

All areas when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.1% (8.9 v. 12.0%).

• In a comparison of the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 2.8% (12.3 v. 9.5%).

• Short sales comprised 2.9% of new listings and 3.4% of sales in the first quarter of 2015, down 0.6% and up 0.4% from the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 6.0% of new listings and 8.9% of sales in the first quarter of 2015, down 2.5% and up 2.4% from the fourth quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.0% (7.7 v. 10.7%).

• In a comparison of first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 1.9% (10.1 v. 8.2%).

• Short sales comprised 2.8% of new listings and 3.0% of sales in the first quarter of 2015, down 1.0% and up 0.1% from the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.9% of new listings and 7.1% of sales in the first quarter of 2015, down 2.0% and up 1.8% from the fourth quarter of 2014, respectively.

Clark County when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.4% (9.3 v. 12.7%).

• In a comparison of first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 2.5% (14.0 v. 11.5%).

• Short sales comprised 4.4% of new listings and 5.0% of sales in the first quarter of 2015, staying even for new listings and up 0.7% for sales when compared to the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.9% of new listings and 9.0% of sales in the first quarter of 2015, down 3.4% and up 1.8% from the fourth quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Distressed Properties Postscript: Looking at Cumulative Days on Market]()

by RMLS Communication Department | Jan 20, 2015 | Distressed Properties, Industry News, Market Trends, Statistics

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Area Distressed Properties (4th Quarter 2014)

• Clark County, WA Distressed Properties (4th Quarter 2014)

• Lane County, OR Distressed Properties (4th Quarter 2014)

• Douglas County, OR Distressed Properties (4th Quarter 2014)

• Coos County, OR Distressed Properties (4th Quarter 2014)

Here are some additional facts about distressed residential properties in the fourth quarter of 2014:

All areas when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.9% (12.0 v. 7.1%).

• In a comparison of the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.7% (9.5 v. 8.8%).

• Short sales comprised 3.5% of new listings and 3.0% of sales in the fourth quarter of 2014, up 0.9% and down 0.3% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.5% of new listings and 6.5% of sales in the fourth quarter of 2014, up 4.0% and 1.0% from the third quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.5% (10.7 v. 6.2%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 1.0% (8.2 v. 7.2%).

• Short sales comprised 3.8% of new listings and 2.9% of sales in the fourth quarter of 2014, up 1.2% and down 0.4% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 6.9% of new listings and 5.3% of sales in the fourth quarter of 2014, up 3.3% and 1.4% from the third quarter of 2014, respectively.

Clark County when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 3.9% (12.7 v. 8.8%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.4% (11.5 v. 11.1%).

• Short sales comprised 4.4% of new listings and 4.3% of sales in the fourth quarter of 2014, up 0.6% for new listings and down 0.4% for sales when compared to the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.3% of new listings and 7.2% of sales in the fourth quarter of 2014, up 3.3% and 0.8% from the third quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Distressed Properties Postscript: Looking at Cumulative Days on Market]()

by RMLS Communication Department | Oct 16, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

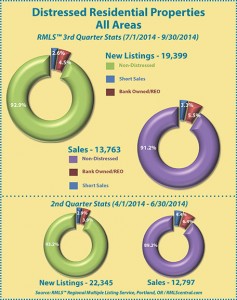

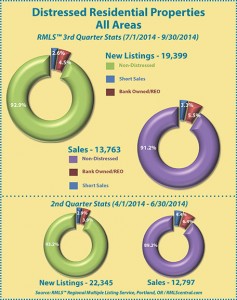

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the third quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (3rd Quarter 2014)

• Clark County, WA Distressed Properties (3rd Quarter 2014)

• Lane County, OR Distressed Properties (3rd Quarter 2014)

• Douglas County, OR Distressed Properties (3rd Quarter 2014)

• Coos County, OR Distressed Properties (3rd Quarter 2014)

Here are some additional facts about distressed residential properties in the third quarter of 2014:

All areas when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.3% (7.1 v. 6.8%).

• In a comparison of the third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 2.0% (8.8 vs. 10.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.3% and 1.1% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.5% of new listings and 5.5% of sales in the third quarter of 2014, up 0.6% and down 0.9% from the second quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.1% (6.2 vs. 6.1%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 1.6% (7.2 v. 8.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.4% and 0.8% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.6% of new listings and 3.9% of sales in the third quarter of 2014, up 0.5% and down 0.8% from the second quarter of 2014, respectively.

Clark County when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings decreased by 0.6% (8.8 v. 9.4%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 4.7% (11.1 v. 15.8%).

• Short sales comprised 3.8% of new listings and 4.7% of sales in the third quarter of 2014, down 0.9% for new listings and 2.0% for sales when compared to the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 5.0% of new listings and 6.4% of sales in the third quarter of 2014, up 0.3% and down 2.7% from the second quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Distressed Properties Postscript: Looking at Cumulative Days on Market]()

by RMLS Communication Department | Jul 16, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

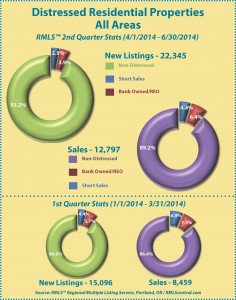

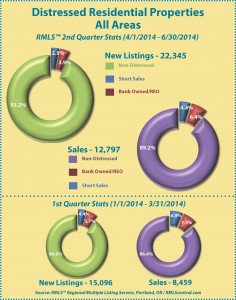

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the second quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (2nd Quarter 2014)

• Clark County, WA Distressed Properties (2nd Quarter 2014)

• Lane County, OR Distressed Properties (2nd Quarter 2014)

• Douglas County, OR Distressed Properties (2nd Quarter 2014)

• Coos County, OR Distressed Properties (2nd Quarter 2014)

Here are some additional facts about distressed residential properties in the second quarter of 2014:

All areas when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.3% (6.8 v. 10.1%).

• In a comparison of the second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.8% (10.8 v. 13.6%).

• Short sales comprised 2.9% of new listings and 4.4% of sales in the second quarter of 2014, down 1.5% and 1.9% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.9% of new listings and 6.4% of sales in the second quarter of 2014, down 1.8% and 0.9% from the first quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 2.8% (6.1 v. 8.9%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.2% (8.8 v. 11.0%).

• Short sales comprised 3.0% of new listings and 4.1% of sales in the second quarter of 2014, down 1.3% and 2.0% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.1% of new listings and 4.7% of sales in the second quarter of 2014, down 1.5% and 0.2% from the first quarter of 2014, respectively.

Clark County when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.1% (9.4 v. 12.5%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 7.3% (15.8 v. 23.1%).

• Short sales comprised 4.7% of new listings and 6.7% of sales in the second quarter of 2014, down 1.2% for new listings and 4.2% for sales when compared to the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.7% of new listings and 9.1% of sales in the second quarter of 2014, down 1.9% and 3.1% from the first quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.