![Residential Distressed Properties for First Quarter (January-March) 2014]()

by RMLS Communication Department | Apr 17, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

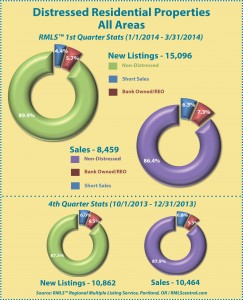

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the first quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (1st Quarter 2014)

• Clark County, WA Distressed Properties (1st Quarter 2014)

• Lane County, OR Distressed Properties (1st Quarter 2014)

• Douglas County, OR Distressed Properties (1st Quarter 2014)

• Coos County, OR Distressed Properties (1st Quarter 2014)

Here are some additional facts about distressed residential properties in the first quarter of 2014:

All areas when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 2.4% (10.1 v. 12.5%).

• In a comparison of the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 1.5% (13.6 v. 12.1%).

• Short sales comprised 4.4% of new listings and 6.3% of sales in the first quarter of 2014, down 1.6% and 0.5% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 5.7% of new listings and 7.3% of sales in the first quarter of 2014, down 0.8% and up 2.0% from the fourth quarter of 2013, respectively.

Portland metro when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 1.7% (8.9 v. 10.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 0.2% (11.0 v. 10.8%).

• Short sales comprised 4.3% of new listings and 6.1% of sales in the first quarter of 2014, down 1.7% and 1.1% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 4.6% of new listings and 4.9% of sales in the first quarter of 2014, even with and up 1.3% from the fourth quarter of 2013, respectively.

Clark County when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 6.1% (12.5 v. 18.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 5.5% (23.1 vs. 17.6%).

• Short sales comprised 5.9% of new listings and 10.9% of sales in the first quarter of 2014, up 2.3% for new listings and 1.8% for sales when compared to the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.6% of new listings and 12.2% of sales in the first quarter of 2014, down 3.8% and up 3.7% from the fourth quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for First Quarter (January-March) 2014]()

by RMLS Communication Department | Jan 22, 2014 | Distressed Properties, Industry News, Market Trends, Statistics

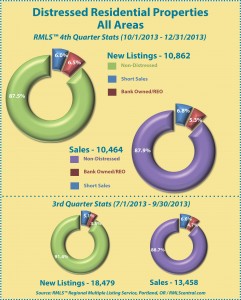

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2013.

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2013.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (4th Quarter 2013)

• Clark County, WA Distressed Properties (4th Quarter 2013)

• Lane County, OR Distressed Properties (4th Quarter 2013)

• Douglas County, OR Distressed Properties (4th Quarter 2013)

• Coos County, OR Distressed Properties (4th Quarter 2013)

Here are some additional facts about distressed residential properties in the fourth quarter of 2013:

All areas when comparing percentage share of the market, fourth quarter 2013 to third quarter 2013:

• When comparing the fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of new listings increased by 3.9% (12.5 v. 8.6%).

• In a comparison of the fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of closed sales increased by 0.8% (12.1 v. 11.3%).

• Short sales comprised 6.0% of new listings and 6.8% of sales in the fourth quarter of 2013, up 0.9% and 0.2% from the third quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.5% of new listings and 5.3% of sales in the fourth quarter of 2013, up 3.0% and 0.6% from the third quarter of 2013, respectively.

Portland Metro when comparing percentage share of the market, fourth quarter 2013 to third quarter 2013:

• When comparing the fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of new listings increased by 3.1% (10.6% v. 7.5%).

• In a comparison of fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of closed sales increased by 1.4% (10.8% v. 9.4%).

• Short sales comprised 6.0% of new listings and 7.2% of sales in the fourth quarter of 2013, up 0.7% and 0.9% from the third quarter of 2013, respectively.

• Bank owned/REO properties comprised 4.6% of new listings and 3.6% of sales in the fourth quarter of 2013, up 2.4% and 0.5% from the third quarter of 2013, respectively.

Clark County when comparing percentage share of the market, fourth quarter 2013 to third quarter 2013:

• When comparing the fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of new listings increased by 4.7% (18.6% v. 13.9%).

• In a comparison of fourth quarter 2013 to third quarter 2013, distressed sales as a percentage of closed sales decreased by 1.9% (17.6% v. 19.5%).

• Short sales comprised 8.2% of new listings and 9.1% of sales in the fourth quarter of 2013, up 0.6% for new listings and down 2.0% for sales when compared to the third quarter of 2013, respectively.

• Bank owned/REO properties comprised 10.4% of new listings and 8.5% of sales in the fourth quarter of 2013, up 4.1% and up 0.1% from the third quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for First Quarter (January-March) 2014]()

by RMLS Communication Department | Oct 15, 2013 | Distressed Properties, Industry News, Market Trends, Statistics

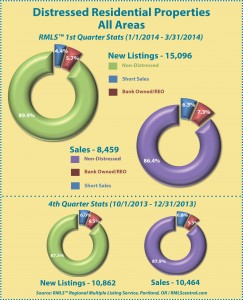

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the third quarter of 2013.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (3rd Quarter 2013)

• Clark County, WA Distressed Properties (3rd Quarter 2013)

• Lane County, OR Distressed Properties (3rd Quarter 2013)

• Douglas County, OR Distressed Properties (3rd Quarter 2013)

• Coos County, OR Distressed Properties (3rd Quarter 2013)

Here are some additional facts about distressed residential properties in the third quarter of 2013:

All areas when comparing percentage share of the market, third quarter 2013 to second quarter 2013:

• When comparing the third quarter 2013 to second quarter 2013, distressed sales as a percentage of new listings decreased by .4% (8.6% v. 9.0%).

• In a comparison of the third quarter 2013 to second quarter 2013, distressed sales as a percentage of closed sales decreased by 4.0% (11.3% v. 15.3%).

• Short sales comprised 5.1% of new listings and 6.6% of sales in the third quarter of 2013, down .6% and 1.9% from the second quarter of 2013, respectively.

• Bank owned/REO properties comprised 3.5% of new listings and 4.7% of sales in the third quarter of 2013, up .2% and down 2.1% from the second quarter of 2013, respectively.

Portland Metro when comparing percentage share of the market, third quarter 2013 to second quarter 2013:

• When comparing the third quarter 2013 to second quarter 2013, distressed sales as a percentage of new listings decreased by .6% (7.5% v. 8.1%).

• In a comparison of third quarter 2013 to second quarter 2013, distressed sales as a percentage of closed sales decreased by 4.0% (9.4% v. 13.4%).

• Short sales comprised 5.3% of new listings and 6.3% of sales in the third quarter of 2013, down .5% and 2.1% from the second quarter of 2013, respectively.

• Bank owned/REO properties comprised 2.2% of new listings and 3.1% of sales in the third quarter of 2013, down .1% and 1.9% from the second quarter of 2013, respectively.

Clark County when comparing percentage share of the market, third quarter 2013 to second quarter 2013:

• When comparing the third quarter 2013 to second quarter 2013, distressed sales as a percentage of new listings decreased by 2.7% (13.9% v. 16.6%).

• In a comparison of third quarter 2013 to second quarter 2013, distressed sales as a percentage of closed sales decreased by 4.8% (19.5% v. 24.3%).

• Short sales comprised 7.6% of new listings and 11.1% of sales in the third quarter of 2013, down 2.1% for new listings and 2.5% for sales when compared to the second quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.3% of new listings and 8.4% of sales in the third quarter of 2013, down .6% and 2.3% from the second quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Residential Distressed Properties for First Quarter (January-March) 2014]()

by Christina Smestad | Sep 13, 2013 | RMLSweb, Statistics

RMLS™ has partnered with Realtors Property Resource® (RPR) and starting September 25th, RMLS™ listing data will be available on RPR to RMLS™ subscribers. RMLS™ subscribers will have access to hundreds of datasets on over 150 million properties across the country through RPR at no additional cost. These reports include:

- Tax assessments

- Notices of default (NODs)

- The largest database of foreclosure and pre-foreclosures in the country

- Mortgage and history data

- Value estimates, refinements, and comp analysis

- Neighborhood and demographic information

- FEMA flood maps

- School zoning and information

On RMLSweb subscribers will be able to quickly access a listing on RPR using the button on the search results screen or at the bottom of an Agent Full report:

RMLS™ and RPR have also integrated ZIP code statistics at the bottom of the Agent Full report on RMLSweb (below). Click the green button (above) that says “[+] RPR Statistics by Zip” to view these statistics, which are based upon the listing’s ZIP code, county, and state.

Additional features and reports will be available by logging in to the RPR website.

RMLS™ subscribers don’t need to take action to register: RPR will be pre-registering our subscribers using their NRDS ID in order to simplify access. Once RPR has created each user’s account (starting September 24th) RPR will send an email to the subscriber.

RPR training sessions will be available for subscribers during the week of September 30th, held at multiple locations across the RMLS™ region (Portland, Vancouver, Tigard, Gresham, Eugene, and Roseburg). Register for an informative RPR training session here.

Watch for an email from RPR with user information starting September 25th!

If you have any questions about your RPR account or the RPR website, please visit the RPR Help Desk or call (877) 977-7576.

by Heather Andrews | Jul 18, 2013 | Distressed Properties, Industry News, Market Trends, Statistics

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the second quarter of 2013.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (2nd Quarter 2013)

• Clark County, WA Distressed Properties (2nd Quarter 2013)

• Lane County, OR Distressed Properties (2nd Quarter 2013)

• Douglas County, OR Distressed Properties (2nd Quarter 2013)

• Coos County, OR Distressed Properties (2nd Quarter 2013)

Here are some additional facts about distressed residential properties in the second quarter of 2013:

All areas when comparing percentage share of the market, second quarter 2013 to first quarter 2013:

• When comparing the second quarter 2013 to first quarter 2013, distressed sales as a percentage of new listings decreased by 6.3% (9.0% v. 15.3%).

• In a comparison of the second quarter 2013 to first quarter 2013, distressed sales as a percentage of closed sales decreased by 9.2% (15.3% v. 24.5%).

• Short sales comprised 5.7% of new listings and 8.5% of sales in the second quarter of 2013, down 3.5% and down 2.9% from the first quarter of 2013, respectively.

• Bank owned/REO properties comprised 3.3% of new listings and 6.8% of sales in the second quarter of 2013, down 2.8% and 6.3% from the first quarter of 2013, respectively.

Portland Metro when comparing percentage share of the market, second quarter 2013 to first quarter 2013:

• When comparing the second quarter 2013 to first quarter 2013, distressed sales as a percentage of new listings decreased by 5.8% (8.1% v. 13.9%).

• In a comparison of second quarter 2013 to first quarter 2013, distressed sales as a percentage of closed sales decreased by 8.8% (13.4% v. 22.2%).

• Short sales comprised 5.8% of new listings and 8.4% of sales in the second quarter of 2013, down 2.9% and 2.8% from the first quarter of 2013, respectively.

• Bank owned/REO properties comprised 2.3% of new listings and 5.0% of sales in the second quarter of 2013, down 2.9% and 6.0% from the first quarter of 2013, respectively.

Clark County when comparing percentage share of the market, second quarter 2013 to first quarter 2013:

• When comparing the second quarter 2013 to first quarter 2013, distressed sales as a percentage of new listings decreased by 7.1% (16.6% v. 23.7%).

• In a comparison of second quarter 2013 to first quarter 2013, distressed sales as a percentage of closed sales decreased by 6.3% (24.3% v. 30.6%).

• Short sales comprised 9.7% of new listings and 13.6% of sales in the second quarter of 2013, down 5.0% for new listings and 5.1% for sales when compared to the first quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.9% of new listings and 10.7% of sales in the second quarter of 2013, down 2.1% and 1.2% from the first quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.